There is a type of equity mutual fund you can invest in which charges you just 0.05% (annual) or 5 paise per ₹100 of investment. What you get is a portfolio of good quality, large cap stocks which can be...

From Outlook Money online 👇

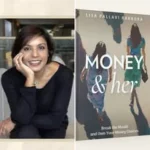

“Because in the end, financial independence is not just about earning, it’s also about having a say.

What follows here is a glimpse into a larger conversation - one that many women have had silently in their heads, and one that this book dares to bring out into the open.”

Thank you Anuradha Mishra for your thoughts around Money & her and publishing an extract from the book - a part that’s closest to my heart 📚🤗

The entire book is, actually.

Money & her really is a conversation, one that’s unmissable for every household!!

Mine included - what about yours❓❗️Answer in comments …

Link in Bio to get your copy of Money & her

@1financehq

[personal finance, money and emotions, women and money, money psychology, women empowerment, emotional finance, money and her, 1 finance]

![From Outlook Money online 👇

“Because in the end, financial independence is not just about earning, it’s also about having a say.

What follows here is a glimpse into a larger conversation - one that many women have had silently in their heads, and one that this book dares to bring out into the open.”

Thank you Anuradha Mishra for your thoughts around Money & her and publishing an extract from the book - a part that’s closest to my heart 📚🤗

The entire book is, actually.

Money & her really is a conversation, one that’s unmissable for every household!!

Mine included - what about yours❓❗️Answer in comments …

Link in Bio to get your copy of Money & her

@1financehq

[personal finance, money and emotions, women and money, money psychology, women empowerment, emotional finance, money and her, 1 finance]](https://moneypuzzle.in/wp-content/plugins/instagram-feed-pro/img/placeholder.png)

When it comes to your investments - sometimes it’s better to just do NOTHING!

The constant news and information about the world and the US and tariffs has riled us all. The sharp market correction may have made you anxious and your anxiety goaded you into selling.

In reality, selling your equity allocation in the correction would have been a losing proposition. Why?

Listen in to the video to understand why taking short term actions in a long term asset can be detrimental to your financial health 💰⛑️😷

JUST DO NOTHING!!

Can you do that???

[money, personal finance, investing, equity, tariffs, wealth, compounding, financia behaviour]

![When it comes to your investments - sometimes it’s better to just do NOTHING!

The constant news and information about the world and the US and tariffs has riled us all. The sharp market correction may have made you anxious and your anxiety goaded you into selling.

In reality, selling your equity allocation in the correction would have been a losing proposition. Why?

Listen in to the video to understand why taking short term actions in a long term asset can be detrimental to your financial health 💰⛑️😷

JUST DO NOTHING!!

Can you do that???

[money, personal finance, investing, equity, tariffs, wealth, compounding, financia behaviour]](https://moneypuzzle.in/wp-content/plugins/instagram-feed-pro/img/placeholder.png)

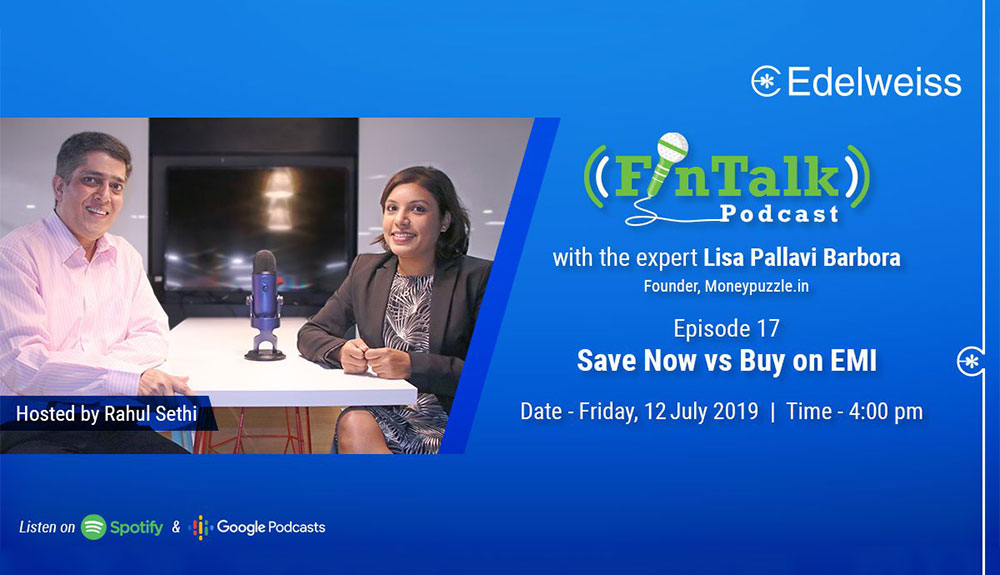

It was a happy moment when I could finally share a copy of Money & her with @edelweissmutualfund Edelweiss MF’s MD & CEO @iamradhikagupta Radhika Gupta.

I literally went on a monologue about the book. She indulged me, listened and asked pertinent questions about the stories and the women in them.

I shared more about the stories I thought she would like to read and hopefully, she will find the time for that! 📚

Thanks Radhika, for taking the time out!!

Money & her is an attempt to nudge women to embrace their financial independence and in doing so, give wings to their unique identities without any hesitation. Your voice on the dual subject of money management and owning one’s identity without fear, is powerful and lends so well to this endeavour.

@1financehq

[personal finance, money and emotions, women and money, money psychology, women empowerment, emotional finance, money and her, saving, budgeting, investing, wealth creation]

![It was a happy moment when I could finally share a copy of Money & her with @edelweissmutualfund Edelweiss MF’s MD & CEO @iamradhikagupta Radhika Gupta.

I literally went on a monologue about the book. She indulged me, listened and asked pertinent questions about the stories and the women in them.

I shared more about the stories I thought she would like to read and hopefully, she will find the time for that! 📚

Thanks Radhika, for taking the time out!!

Money & her is an attempt to nudge women to embrace their financial independence and in doing so, give wings to their unique identities without any hesitation. Your voice on the dual subject of money management and owning one’s identity without fear, is powerful and lends so well to this endeavour.

@1financehq

[personal finance, money and emotions, women and money, money psychology, women empowerment, emotional finance, money and her, saving, budgeting, investing, wealth creation]](https://moneypuzzle.in/wp-content/plugins/instagram-feed-pro/img/placeholder.png)

Mixing up the head and the heart

Money has a practical side but it also has a very emotional side.

How much we use our heart and emotions to make money decisions, affects the practical outcomes we desire from our money.

My process while writing Money & her - a bit of heart and a bit of head 🙂💕

1 Finance

Buy it here 👇

Amazon: https://1fin.me/41v27C6

Flipkart: https://1fin.me/43a7fwt

[personal finance, money and emotions, women and money, money psychology, women empowerment, emotional finance, money and her, 1 finance]

![Mixing up the head and the heart

Money has a practical side but it also has a very emotional side.

How much we use our heart and emotions to make money decisions, affects the practical outcomes we desire from our money.

My process while writing Money & her - a bit of heart and a bit of head 🙂💕

1 Finance

Buy it here 👇

Amazon: https://1fin.me/41v27C6

Flipkart: https://1fin.me/43a7fwt

[personal finance, money and emotions, women and money, money psychology, women empowerment, emotional finance, money and her, 1 finance]](https://moneypuzzle.in/wp-content/plugins/instagram-feed-pro/img/placeholder.png)

EMPOWERING …

This is the term I’m coming across in so many reader reviews for Money & her

In this personal finance book, numbers take a backseat.

The idea behind the book is to nudge women to own their financial independence in its entirety. 🙌

This is not just about women being able to earn …

… its about participating in money decisions that impact your family

… it’s about managing money to achieve your life’s desire

…. its about understanding that personal

finance is basic hygenie and not entertainment

Its also not a feminist statement or a challenge to men, rather I explore how we can have collaborative experiences.

I hope that every household gets a copy of Money & her and it continues the job of empowering women and uplifting families in this journey 😊😊

Get your copy today 👇

Amazon: https://1fin.me/41v27C6

Flipkart: https://1fin.me/43a7fwt

#personal finance #money #empowerment #saving #budgeting #investing #financialcoaching

An incredibly humble leader and MF industry veteran, @pgimindiamf, CEO, Ajit Menon was not only very welcoming when I stepped into his office to share a copy of Money & her, but also the conversation around how behaviour impacts investing was so engaging that I missed capturing the moment in a picture!!

He was kind enough to send me one later! 📚 😊

Ajit’s thoughts around comprehensive personal finance solutions linked to behaviour and suitability come forth like a fresh breeze and you realise how critical it is to shift our mindset away from products and towards solutions. Solutions which are unique to each individual and family. Focussing on solutions makes room for financial products with many varying features depending on unique requirements and behaviour.

Thank you Ajit for taking the time out and for the thought provoking conversation.

Money & her is also a conversation, around financial independence which looks beyond just your ability to earn, towards your ability to own your identity and use your money to enable a life that’s most aligned with your core values.

Let’s continue to take this conversation forward!!

@1financehq

#personalfinance #money #investing #wealth #saving #spending #womenandmoney #finance

It was amazing to share Money & her with MF industry leader Nimesh Shah under whose guidance @iciciprumf has always steppped up to support personal finance conversations across platforms.

We agreed on how a personal finance book that speaks directly to women is a definite need and he promised to start reading the Money & her preface soon!!

Thank you for taking out time and it would be great to hear your thoughts on Money & her.📚

Big thanks to @ambakhshi too who is always generous with his time.

Let’s take this conversation forward!!

@1financehq

#money #investing #equity #saving #spending #personalfinance

Understanding our relationship with money is the key to future action.

Writing Money & her helped me become not just entirely aware of my relationship with money but also gave me the courage to own my insecurities with money...

What is your money relationship like?

@1financehq

#wealth #money #personalfinance #womenandmoney #financialcoaching #investing #risk #return #moneybehaviour #saving #spending

It was awesome to meet the ladies who talk money !!!

Money & her @fincocktail 🎰🍸

Their energy around money conversations is infectious 😊

Have you got your hands on Money & her yet??

Link in Bio

#money #womenandmoney #personalfinance #wealth #saving #investments

Money & her: Talking about money is good for you

The pointlessness behind reckless trading risks

investment

Not equity returns, it’s asset allocation that matters most

The pointlessness behind reckless trading ...

Equity investing is more reliable ...

planning

Let’s settle this once and for all: rent versus buy

How to reach financial freedom

Why do we hate the ...

expert-byte

Quote of the Week

"Incentives are the silent architects of our financial destiny, shaping every choice we make with whispers of opportunity or consequence."