Photo by Rodolfo Quirós from Pexels

LIC Home Finance, Union Bank, HDFC Ltd are some lenders who are now offering you a home loan at 6.9% a year. Just a year or two ago, you were looking at a home loan rate of 8.5% a year. Clearly, this is a discount if you just look at numbers. However, it’s not the same as buying clothes on discount and you need to dig deeper before you commit.

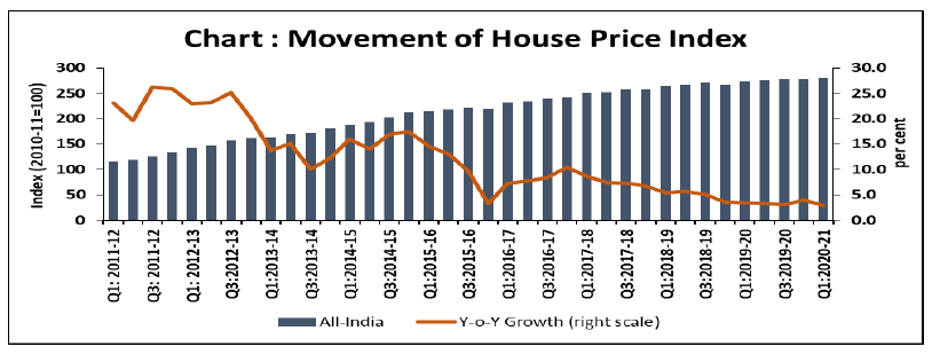

It is tempting when you think that home prices are falling. According to the latest data from the Reserve Bank of India, the quarterly house price index has trended downwards from a high of 250 in Q3 2011-12 (Sep 2011-Dec 2011) to below 50 in Q1 2020-21 (Apr 2020-Jun 2020).

The graph does show a small increase compared to the previous year, but if you consider the general demand and sentiment, things may take a while to pick up. Moreover, there is a reason that home prices have fallen. The demand for the affordable housing segment seems to be reviving according to various surveys which indicate more search and interest in this segment. At the same time, there is a lot of supply in urban areas which is lying unused and affordability has reduced. This gives a sense that prices may not have seen the bottom yet.

With pandemic led economic slowdown and income uncertainty there is no clear case of a revival in real estate demand or prices, there could be micro market uptrends in certain segments but a macro trend seems far.

What really matters

As an individual who is looking at buying a home, all of this is irrelevant. What matters is your ability to afford the home of your choice.

There are many reasons to buy a house but simply following social norms can’t be one. What I mean is that if you are looking at buying a house because that’s what you should do, think again.

The lower home loans rates act as a lure but you have to see them in light of how low the current yield on real estate assets is.

What is the yield on real estate?

Yield on real estate is basically, the income you can potentially earn from it. The income you earn from real estate is rental income. The technical calculation for yield is annual rent divided by the market price of the house.

Currently, the rental yield on residential real estate in major Indian cities is roughly 2%-2.5% per year. Think of it like your fixed deposit interest; you earn roughly 4.4% per year from a SBI fixed deposit, before tax. In reality, real estate as an asset gives you income which is lower than a fixed deposit.

You may argue that you are buying to live in the house and hence, rental yield does not matter. Rental yield is not only about what you can realistically earn from real estate, but also an indicator of whether the asset is well priced or not.

When you take a loan at 6.9% per year, you are paying an interest rate which is way higher than your potential income yield of 2.5% from the same asset.

A cost vs income analysis would throw this idea out the window; except for the one assumption we make about real estate as an asset.

The long-term growth

Real estate is a long-term growth asset and more than that owning it gives individuals and families emotional security.

Before we talk about the non-financial reasons for buying real estate, let’s try to understand why it works as an asset despite the low rental yield. The attractiveness of real estate is in long term wealth creation or growth. We know that supply of land or space is limited and over time built up area on this limited resource will find value. The value of the house itself may appreciate or not based on whether you have bought it in a popular location, or one that is picking up interest, with a reliable developer and at a reasonable price and so on. Over a period of 10-15 years, the assumption is that home prices will rise.

This is a reasonable assumption and expectation to have. However, here is where it gets complicated: the degree of price rise is location specific and hard to pin down. Plus, you are likely to take a loan, hence all the gains are not yours. Lastly, you need a large lump sum to buy, redemption also can only be done in one chunk.

Again, this entire line of argument is irrelevant if you are buying a house to live in and that’s where the emotional reasoning kicks in.

Why we really buy a house

It’s because social norms have made us put on rose coloured glasses when it comes to home purchase. To own a home is somehow linked to your social status and progress in life. School, college, job, marriage, HOME PURCHASE, children. This is the route encouraged for all young individuals. Living on rent is somehow considered only from a perspective of being able to afford buying as opposed to being a convenience.

What we don’t realise is that unlike two or three decades ago, when most people built or bought homes with their own money, today home buying is on 90% loan. To this one adds home improvement loans as well. It tells us that home prices have shot up over the years beyond affordability or rather a false sense of affordability has been created thanks to readily available loans.

Moreover, no longer do people live and work in the same area – at least in cities. Affordability in the office district is a lot lower and one tends to move far away in search for owning a home.

Once the 90% loan has been taken for a home which is 10-15 kms or more away from your work place, then after the initial euphoria begins the pain. The pain of travelling 1-2 hours one way in traffic, the pain of repairs, taxes and society meetings. Ten years later the potential pain of having to stick it out in a job you don’t like simply to afford the EMI on a large loan, you assumed you would have repaid by now.

If you are buying a home today for emotional reasons, for this sense of security or simply because your elders are pushing you to, then think long and hard before taking the plunge – because buying a house on a hefty loan is really not a sound financial decision.

6.9% loan caveat – what to watch out for

Now coming back to these discounted home loan rates. Here’s the thing, while the marketing and advertising material only talk about one rate, in reality, there is always a range. Watch out for these factors:

- 6.9% a year is a home loan interest rate offered to women borrowers, for a loan up to Rs 30 lakhs and only for those with the best credit assessment. For others, the rate varies from 6.9%-7.55% a year.

- It is a floating rate loan or adjustable rate, most lenders retain an open option to change the applicable home loan rate when its prime lending rate changes.

- The prime lending rate is really the benchmark for any lender and currently for private lenders it is around 16% a year.

- Your EMI at 7% a year for a loan of Rs 1 crore will be roughly Rs 76,000. For a tenure of 20 years, the total interest paid can potentially equal 85% of the loan amount.

YOU ARE PAYING NEARLY DOUBLE THE PRICE OF THE HOUSE THANKS TO INTEREST.

- If you delay on payment of interest or EMI, there is something called a penal interest rate which comes into play and can potentially be as high as 24% a year. Make sure you don’t delay any payments.

- There is also a pre-payment penalty up to 2% of the outstanding principal.

- For the first ten years of your loan tenure, the interest component will be higher than the principal repayment in your annual EMI.

There are unstated issues too. Some lenders are simply not proactive on rate changes on the way down, whereas rate hikes are followed through with precision. Taking on a floating rate loan at a low interest coupon may feel like a win today, but a long tenure loan of 20 years or so is likely see a period of very high rates too.

I would recommend extreme caution in taking up a home loan simply because of the 6.9% offer today. If you were already sitting on the fence in this context and unsure of whether you should or not, then perhaps this is the candy that pulls you over.

Advertisements from real estate companies and housing loan companies sell you shiny dreams and a polished reality. Scrape it a bit and you’ll realise that the shine and polish come from a toxic wax coating, which, you really don’t need to absorb into your life.

Buying a home should be a decision that you never have to look back on, one that doesn’t tie you down or feel like a burden tomorrow. One that you make where you are sure to have put down your roots. Don’t rush into it – in today’s market, even the economics of the decision are against the decision to buy.

Tread carefully.