Photo by cottonbro from Pexels

If safety is the priority then the type of investments you pick will be slightly different from what you need to create and grow your money.

What you need to understand though is that safety comes at a price too. The price usually is low returns. At the same time, it’s important to point out that looking for efficient returns is not always about getting the highest return. It is more about being able to balance risk and return in a way that achieves your purpose of making an investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More.

Why look for safety in returns?

If you are looking for safety in returns, it could be because you need the money in a short period of time and prefer to earn a slightly higher interest than you get in a bank or it could be that the purpose for which you are keeping this money aside is of utmost importance.

For example, building an emergency fund is a financial objective where you can not afford to compromise on safety of return, simply because you need the money for an emergency and you may need the money at any time. Another reason could be to balance out your overall portfolio risk. If you already have allocation to growth assetsGrowth assets as against fixed return assets are those which grow your capital or principle investment. The most common forms of growth assets are equity stocks and property. Investing in equity stocks means you buy a portion of the underlying... More like real estate or equity, you may want an element of stability in the portfolio through long term assets where the capital is relatively safe.

What comes first

When we think of safety, the Sovereign comes to mind. Out Government does issue bonds for individual investors which are available periodically. Usually these are long term in nature, meaning you have to remain invested for 5 years or more, they don’t come with the flexibility of early withdrawal and the interest earned is taxable.

While such options can work for conservative, senior investors looking for regular income, it is not so suitable for a young investor to lock in money with such bonds.

There are also Government securities of varying tenure or maturity periods which are listed on stock exchanges. These can be bought and sold directly from the exchange and find a lot of favour among large institutional investors. While there is the flexibility to exit by selling in the exchange, for retail investors this process may not appeal because of low liquidity for small quantities and amounts.

Nevertheless, Government Securities or G Secs as they are known are a desirable option, both for short and long-term allocation. They are safe and are quick to reflect the interest rate prevalent at the moment. If you are not able to access them directly look for debt mutual funds which invest in G Secs.

For long term allocation there are 10-year G Sec funds which only invest in 10-year maturity G Secs; DSP, ICICI, IDFC and SBI mutual fund have these products. While the underlying investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More of the fund remains the same, you can buy and sell as required, however, this is ideally a five year plus investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More product with safety of returns and low risk. There are other short duration debt funds which primarily invest in G Secs.

Almost every large fund house will have a short duration debt fund, look for one which has at least 40%-50% of the portfolio in Government securities. You will find this portfolio investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More in their monthly factsheet published on the website. Too much work? Ask an advisor!

Use a combination of the two types to types of debt funds for your safe allocation in the portfolio.

Small savings schemes

The next place we look are small savings schemes like Post Office Deposit or National Savings Certificates. However, these are not very efficient when it comes to tax and they are all long term locked in products. Without the flexibility to exit any time, such products have little to offer young investors who have the ability to use the long-term allocation for wealth creation through growth assetsGrowth assets as against fixed return assets are those which grow your capital or principle investment. The most common forms of growth assets are equity stocks and property. Investing in equity stocks means you buy a portion of the underlying... More like equity.

Most people are drawn to these schemes because of regular income through interest, but these is not the same as seeking safety of capital first. Again, these are better suited to senior investors looking for income along with safety.

I would say these are avoidable for your short- or long-term safe return choices.

Public Provident Fund

The tax efficiency of this product makes it desirable. All returns made are completely tax-free and yearly contributions to PPF are tax-deductible up to a maximum of ₹1,50,000.

Otherwise, this product is also locked in for 15 years and inefficient when it comes to short term allocation for the safety of returns. For a 15-year allocation, your choice is really between PPF and equity assets; data shows us that in such a long period, equity has the potential to deliver 12%-15% annual return if you remain disciplined and don’t withdraw in between. At present PPF is giving 7.1% annual return.

I would say allocating to equity for the long term, instead of PPF is a risk worth taking.

Interest rates on Government-backed savings schemes

While the interest rate looks better relative to some market-linked funds, there is a lock-in period and penalty for premature withdrawal. Plus, long term tax efficiency is poor for all other than PPF

| Tenure | Annual interest rate | Taxation | Tax deduction | |

| Public Provident Fund | 15 Year | 7.10% | Tax free | Available under 80C |

| Post Office Term Deposit | 3 Year | 5.50% | Interest taxed at income tax rate | |

| Post Office Term Deposit | 5 Year | 6.70% | Interest taxed at income tax rate | Available under 80C |

| National Savings Certificate | 5 Year | 6.80% | Interest taxed at income tax rate | Available under 80C |

Bank deposits

These are the go-to products when it comes to wanting safety of return. The plus point is also that bank deposits are available in various maturities and you can pick and choose a short term or a long-term deposit.

However, the downside is that post tax returns are sub optimal when compared to certain market linked products like short duration debt funds and for early withdrawal you will have to pay a penalty.

Keep in mind also that all bank deposits are not the same. Quality is a concern when it comes to deposits. In recent memory, PMC bank depositors have suffered and the same fate could have happened to Yes Bank depositors before the bail out.

Gold

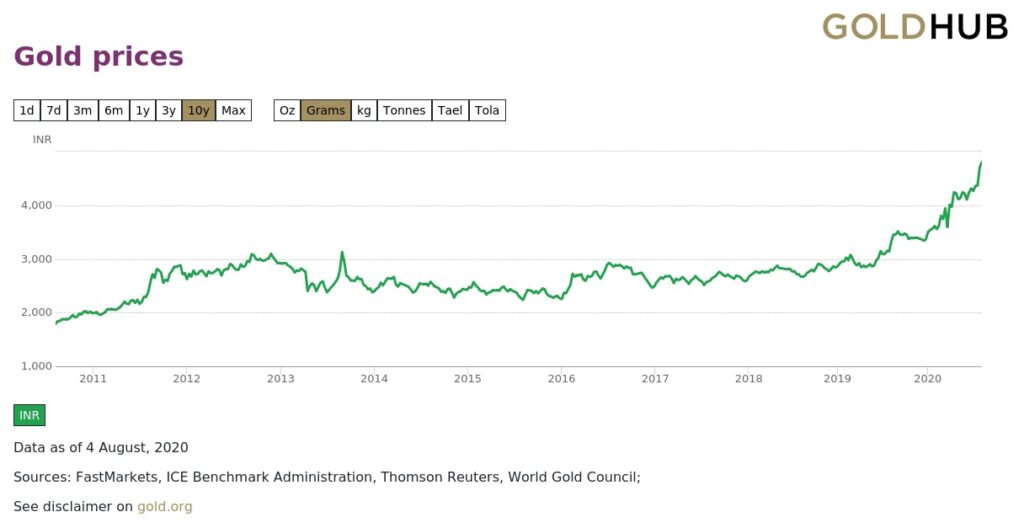

Traditionally considered as a safe option, your returns from gold are solely dependent on the price fluctuation of this yellow metal. While the last one year has been super with 40%-45% return, for 7-8 years before that, return was falling or sideways because price of gold was in doldrums.

Gold prices in the long term trace the annual inflationInflation is a common term thrown around in economics lessons and by politicians around election time. What it means in simple language is that prices of things you buy, stuff, keeps increasing every year. It happens because the economy in... More in an economy. Since, India imports practically all its gold, this also means that the change in our currency impacts its local price. If the Rupee falls in value against the dollar, price of gold in India will actually go up. This also means, inflationInflation is a common term thrown around in economics lessons and by politicians around election time. What it means in simple language is that prices of things you buy, stuff, keeps increasing every year. It happens because the economy in... More in the economy will go up.

Hence, gold over long periods ends up tracing inflationInflation is a common term thrown around in economics lessons and by politicians around election time. What it means in simple language is that prices of things you buy, stuff, keeps increasing every year. It happens because the economy in... More rather than giving you a real return. It is a good store for the value of your money, but you shouldn’t look for safety in the short term as price can fall just as easily as it can rise.

If you had bought Gold in 2012, for example, with the objective of a safe return for a short period, the mistake would cost you dearly.

The chart below shows why.

Hence, gold is not a reliable safe investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More for the short term and in the long run, expect returns which trace inflationInflation is a common term thrown around in economics lessons and by politicians around election time. What it means in simple language is that prices of things you buy, stuff, keeps increasing every year. It happens because the economy in... More in the economy.

Debt mutual funds

There are various types of debt mutual funds which can help you with short or long term safe return objective. What you need to be careful about is, not getting bothered by the daily volatility in price. Remember, in the previous blog we told you that mutual funds are market-linked products and that means there will be some daily price fluctuation.

However, if you are able to match the time frame for when you need to be invested with the maturity profile for the debt fund you will be fine. Also, recall we said that quality is of utmost importance. To ascertain quality, you will have to peek into the portfolio of the scheme which is published on the fund house’s website periodically.

Post-tax returns after 3 years are more efficient than other fixed-income options, however, you have to ensure that you eliminate quality risk by choosing the highest quality portfolios from consistently performing funds.

| Debt Mutual Funds | |||

| For short term allocation | Current expected annual returns | Safety | Total schemes considered |

| Liquid Funds | 3.5%-3.75% | All schemes in the category have a AAA profile | 42 |

| Ultra-Short Term Funds | 6.5%-7% | Barring 2 schemes all have highest credit quality | 27 |

| Low Duration Funds | 8.5%-9% | Barring 4 schemes all have highest credit quality | 21 |

| For Medium Term Allocation | |||

| Short Term Income Funds | 9.5%-10% | Barring 4 schemes all have highest credit quality | 20 |

| Banking and PSU Sector Funds | 10%-11% | All highest credit quality | 20 |

| For Long term Allocation | |||

| Constant Maturity G Sec Funds | 10%-11% | Highest credit quality | 4 |

Many funds have altered their portfolios to accommodate only high credit quality bonds given the current market situation. However, there is no guarantee that the portfolios will always reflect the highest degree of quality. Hence, doing a cursory portfolio check for the specific scheme you want to invest in, is important.

All this seems like a lot, and hence, most people prefer bank deposits. However, the flexibility and tax efficiency of debt mutual funds can go a long way. Short term capital gains tax applicable to debt fund gains is the same as what you would pay on interest received on other fixed income products like deposits. However, if you hold your fund for at least 3 years, original cost is indexed to inflationInflation is a common term thrown around in economics lessons and by politicians around election time. What it means in simple language is that prices of things you buy, stuff, keeps increasing every year. It happens because the economy in... More which brings down the gains and the subsequent tax on it. It’s just a matter of getting used to something different.

Summary

When it comes to investing with the purpose of keeping safety of returns in mind, don’t chase that additional 1%-2% return as you will end up compromising safety. A small private bank may offer you a higher interest fixed deposit, but in an uncertain economic environment, the health of the bank may be questionable. You rather stick to the well-established, large sized banks.

The same is true for debt funds, if safety is important, then don’t chase the highest return product in a category. Check the monthly factsheet. Allocation to Government Securities and AAA rated bonds is the most desirable.

Gold is not safe for short term allocation. At the same time, market linked products like debt funds can cater to your anytime, flexible need for short term allocation despite some amount of daily volatility.

Choose your safe investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More wisely and don’t compromise on quality.