If you are a freelancer or a Gig Worker you need to a just that little bit more careful and conscious about your money choices. Here are three things to keep in mind.

1. Fame is not fortune

No matter how good and popular you are or what you do is, it does not automatically translate into a high income or pots of money. Hence, you must focus on creating an emergency fund to dip into when income becomes uncertain.

2. Short earning life

For some freelancers, especially those working in sports and entertainment, active earning years themselves can be limited. Have a plan B and start saving and investing early to help your future years.

3. Risk of uncertain income

When the nature of income is uncertain, ensure that you are not taking too much risk in your investments. First, build up a pile of accumulated savings through stable return investments and then focus on the risky growth assetsGrowth assets as against fixed return assets are those which grow your capital or principle investment. The most common forms of growth assets are equity stocks and property. Investing in equity stocks means you buy a portion of the underlying... More.

Also read:

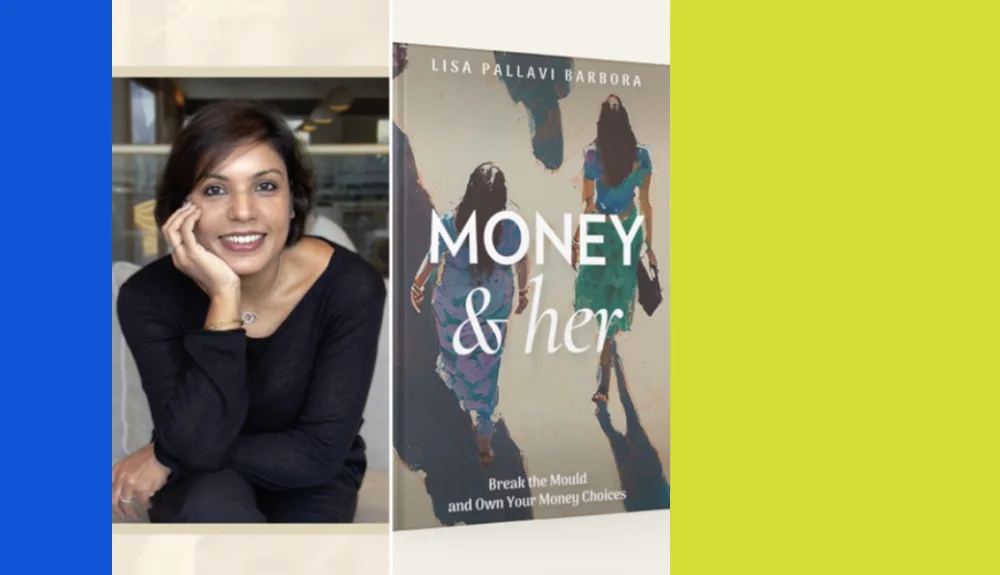

Money & her: Talking about money is good for you

One of the objectives behind writing ‘Money & her’ was to get conversations going. Conversations about personal money. Not in public but at least within your household where these conversations can literally change the trajectory of your future.

Not equity returns, it’s asset allocation that matters most

The markets are correcting and that’s no news, but yes, we haven’t seen this sharp a downtrend is a while now.