Thinking of buying your first home? Must be an emotional high point in your life. However, before you commit to this responsibility of homeownership, stop and think.

Don’t make the mistake of

- Only relying on a loan for the house is going to cost you in terms of a high-interest cost. For a 90% loan – interest cost over 20 years can potentially be as much as the cost of your home. Ensure that you use at least 40%-50% of your own savings towards the house value and then take a loan for the rest

- Your housing loan EMI can last for a long time, make sure it does not become a burden if you want to change your job, professional status and work life. To do this, keep the EMI not more than 40%-50% of your post-tax monthly income – so that if there is a point where you want to take a break or change your job or even lose your job, the EMI doesn’t feel like a burden

- Think about aspects like location, commute time, quality of builder, neighbourhood, access to amenities – not just for now but also ten years later while making the choice of your home. You don’t want to spend the bulk of your time on the road trying to reach home – while simultaneously worrying about high pollution levels in your locality.

Build a life in your new home – not just a house.

Also read:

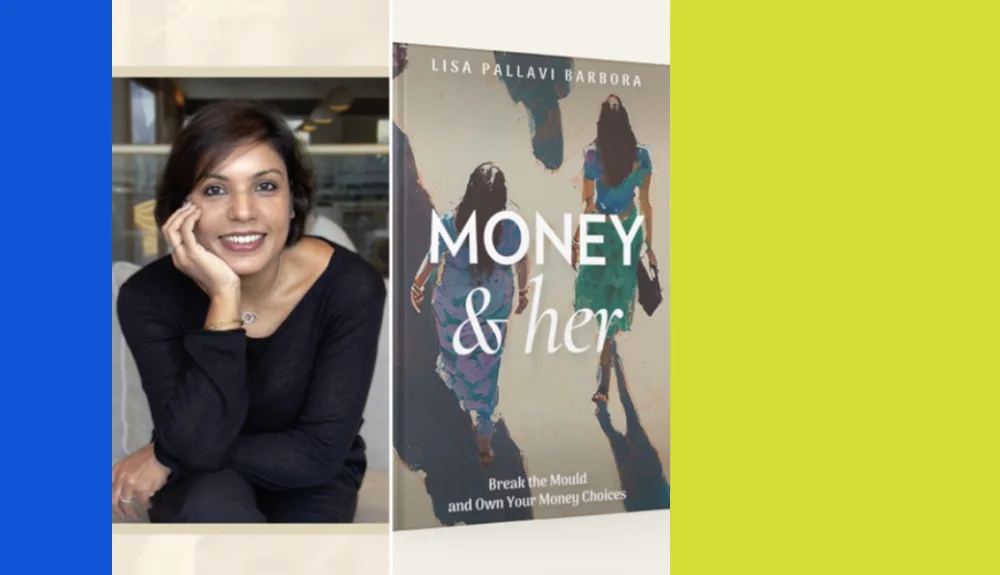

Money & her: Talking about money is good for you

One of the objectives behind writing ‘Money & her’ was to get conversations going. Conversations about personal money. Not in public but at least within your household where these conversations can literally change the trajectory of your future.

Not equity returns, it’s asset allocation that matters most

The markets are correcting and that’s no news, but yes, we haven’t seen this sharp a downtrend is a while now.