It’s time to say Happy New Year – wishing you the best in 2026! Despite the celebration that invariably ensues – worldwide – to mark the change in the calendar year, a new calendar year, is actually a change that bears no practical significance for our lives.

New NPS rules by PFRDA 📌

More flexibility for your retirement planning, if you are a non government employee investing via NPS.

• Withdraw up to 80% of your corpus at retirement

• Mandatory annuity reduced to 20%

• Full withdrawal allowed for smaller corpus thresholds

• Option to stay invested longer, even beyond 60

• More control over how and when you access your money

Bottom line: Retirement planning just got more flexible, tax efficient and investor-friendly.

👉 DM to understand how these changes impact your retirement plan

👉 Save this post for later & share with someone planning for retirement

#NPS #NationalPensionScheme #RetirementPlanning #PFRDA #RetirementReady #PersonalFinance #FinancialPlanning #WealthManagement #LongTermInvesting #FinancialWellbeing #FinanncialCoaching

He arrived with irresistible charm and an aura of positivity—selling equity & commodity trading like a spiritual experience.

With loud, misleading marketing, pulling in lakhs of subscribers wasn’t hard.

But here’s the truth 👇

Our beliefs, emotions, and behaviour often drive us to follow stock-market godmen.

Investing isn’t spiritual.

It’s psychological. Strategic. Disciplined.

It’s about numbers—not dancing or chanting.

These are my reflections on how misplaced beliefs and emotional influence led many to subscribe to courses that ultimately delivered little value.

Read more on Moneycontrol 🔗 Link in story

https://www.moneycontrol.com/news/opinion/the-avadhut-sathe-saga-betrayed-by-the-pied-piper-or-your-own-behaviour-13727285.html

#equity #trading #investing #SEBI #scam #behaviour #personalfinance

Too many investors still let emotions, charisma, and “market gurus” steer their decisions, and the recent SEBI order against Avadhut Sathe proves exactly why that’s dangerous.

When you choose emotion over logic, you choose risk over regulation.

Every long-term wealth setback starts with:

• getting impressed by persona

• believing returns that don’t add up

• ignoring the absence of regulation

• falling for hype instead of process

If your money took years to earn, stop letting seconds of emotional impulse decide its fate.

Comment “LOGIC” if you’re choosing discipline over drama.

logic over emotions investing, SEBI order Avadhut Sathe, retail investor mistakes, emotional investing risks, regulated investments India, financial literacy India, wealth creation discipline

#LogicOverEmotions #InvestSmart #SEBI #InvestorAwareness #RetailInvestors

#FinancialWisdom #WealthMindset #PersonalFinanceIndia #MarketEducation

#InvestingMistakes #LongTermInvesting #MoneyMindset

As 2025 comes to a close, investors are STILL making these costly mistakes. Are you guilty of any?

Swipe through to see the 7 errors that have wiped out portfolios this year (and how to avoid them as we head into 2026).

The market has a way of humbling even the smartest investors. From chasing meme stocks to panic selling during dips, these mistakes have cost people MILLIONS throughout 2025.

Here’s what went wrong:

• FOMO into hyped stocks without research

• Emotional selling during corrections

• Zero diversification strategy

• Over-leveraging with margin/options

• Blindly following social media “gurus”

• Trying to time the market perfectly

• Following the herd into bubbles

The good news? Every mistake is a lesson. The investors who survived and thrived were the ones who stuck to their strategy, managed risk, and kept emotions in check.

Question for you: Which mistake have YOU made? Drop a number (1-7) in the comments. Let’s learn from each other! 💬

Save this post so you can review it before making your next investment decision. Your future self will thank you.

Want daily investing insights and market analysis? Follow @moneypuzzle for content that actually helps you grow your wealth.

📊 Share this with someone who needs to see it.

Stock market mistakes, Investing mistakes 2025, Market crash lessons, Investment tips, Trading psychology, Portfolio management, Financial mistakes, Stock market strategy, Investment advice, Market corrections

#InvestingTips #StockMarketTips #FinancialEducation #MoneyManagement #InvestSmart #TradingTips #MarketAnalysis #WealthBuilding #FinancialFreedom #InvestorLife #PortfolioManagement #SmartInvesting #MarketMistakes #InvestmentStrategy #InvestingMistakes #StockMarket2025 #TradingPsychology #MarketStrategy2026 #MoneyPuzzle

Everyone loves an 8% GDP headline—until they look under the hood.

Markets aren’t cheering because the fundamentals aren’t lining up.

FIIs dumping ₹1.5 lakh crore, inflation collapsing to almost zero, and the rupee sliding—none of this screams “bullish”.

GDP can look great on paper, but equity markets respond to earnings, sentiment, and currency stability.

Right now, the story isn’t matching the numbers.

If you’re investing blindly on GDP headlines, you’re not paying attention.

GDP growth, FII selling, Inflation mismatch, Rupee depreciation, Equity market sentiment, India macroeconomy, Market outlook

#GDPIndia #IndianEconomy #StockMarketIndia #FII #Inflation #INR #MacroUpdates #MarketExplained #FinanceReels #InvestingInsights #MoneyPuzzle

Meeting Devina Mehra reminded me why real success never needs noise.

She’s built a global track record in equity research with brutal discipline, intellectual honesty, and zero shortcuts—yet remains grounded, curious, and disarmingly human.

What struck me most wasn’t just her market genius, but the way she carries her stories: her feminism without theatrics, her vulnerability without hesitation, and her unshakeable respect for the people who shaped her.

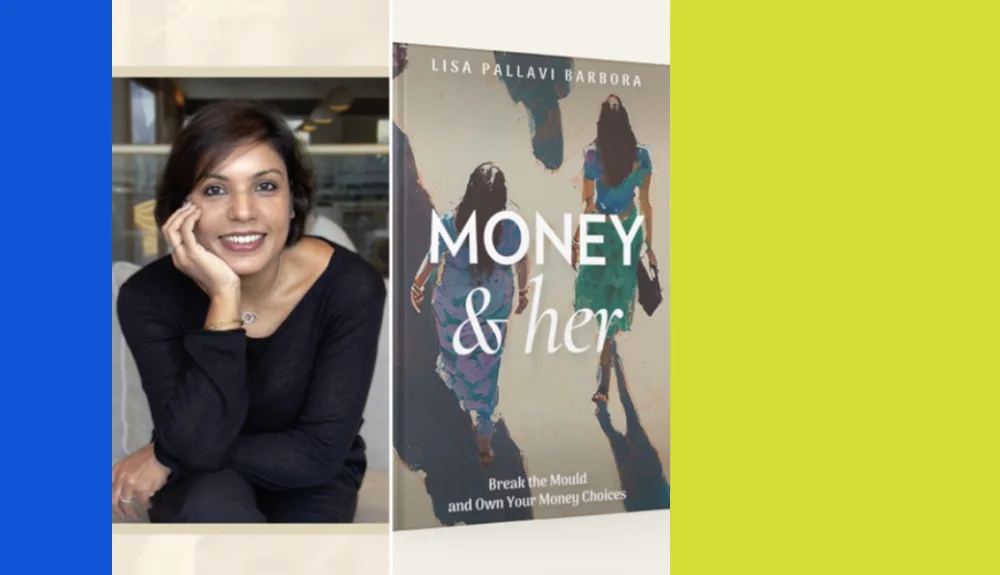

I knew I had to share Money & Her with her—because financial independence isn’t a luxury for women, it’s the foundation of identity, freedom, and real power.

We shot a raw, five-minute reel with fading light, loud wind, and unplanned questions. She gave unfiltered answers.

And yes—I walked away with a signed copy of Money, Myths & Mantras.

If you’ve ever wondered what authentic success looks like, this conversation is your answer.

Devina Mehra interview, Money & Her book, women and financial independence, female investors in India, equity research insights, personal finance for women, women in finance inspiration, real success stories India

#DevinaMehra #MoneyAndHer #WomenAndFinance #FinancialIndependenceForWomen #WomenWhoInvest #IndianMarkets #EquityResearch #MoneyMindset #FinanceReels #InspiringWomen

Most investors assume IPOs and mutual fund NFOs are “new opportunities” in the same way, but they’re not.

One gives you access to a newly listed business.

The other is usually just a new wrapper around stocks that already exist in the market.

Here’s the part most people ignore:

Neither of them deserves FOMO.

New doesn’t mean better.

If anything, it means higher uncertainty.

Before committing money:

– Check whether the business (IPO) actually performs for a few quarters.

– Check whether the fund (NFO) can deliver consistent returns for 2–3 years and beat its benchmark.

If it can’t justify itself with data, skip it.

Chasing “new launches” is how investors burn capital.

Evaluating them with patience is how you build wealth.

IPO vs NFO, IPO investment India, NFO mutual fund India, Should you invest in IPO, Should you invest in NFO, New fund offer explained, IPO mistakes India, Mutual fund beginners India, Equity investing India, Long-term investing India

#IPOVsNFO #IPOIndia #NFOIndia #MutualFundIndia #InvestingForBeginners #StockMarketIndia #EquityInvesting #PersonalFinanceIndia #MoneyPuzzle

Before you put money into anything that looks “easy”, ask the only question that actually matters:

Is it regulated, audited, and legally protected?

Digital gold may look convenient, but SEBI has clearly stated that these products don’t fall under their regulatory framework.

That means no guaranteed oversight, no clarity on the gold backing, and no investor protection if something goes wrong with the platform.

If you’re investing for safety or long-term wealth, regulated options like Gold ETFs and Sovereign Gold Bonds give you transparency, legal safeguards, and better cost efficiency. Convenience is great, but not when it comes with hidden risk.

Be curious, not casual — especially with your money.

SEBI digital gold warning, digital gold risks India, is digital gold safe, digital gold vs gold ETF, SEBI investor caution, unregulated gold products, safe ways to invest in gold India, unregulated digital gold, investor caution India, gold investment safety India, money puzzle

#SEBIAlert #DigitalGold #InvestorAwareness #GoldInvesting #MoneyPuzzle

SIPs didn’t hit a ₹29,529 crore inflow by accident.

This didn’t happen because people suddenly “felt like investing.”

It happened because more Indians finally realised one uncomfortable truth:

👉 Market timing is a losing game — systems win.

SIPs work not because they’re convenient, but because they force the behaviour most investors fail at: consistency.

Here’s the part most people ignore but matters way more than fund selection:

1️⃣ SIPs aren’t just for equity.

Use them in liquid funds for your emergency corpus, short-term income funds for debt allocation, or even gold funds for diversification.

2️⃣ There’s no expiry date.

Start once. Run it for 10–20 years.

Stopping the SIP ≠ redeeming your money.

3️⃣ Top-up or stay behind.

Increase your SIP by 5–10% every year.

This one habit compounds faster than your fund returns.

The point is simple:

SIPs aren’t magic — your discipline is.

Use the tool right, and the market becomes your long-term partner, not your stress trigger.

mutual fund sip strategy india, sip inflow data october 2025, sip vs market timing, sip top up benefits india, sip for beginners india, long-term wealth creation india, personal finance investing tips india, sip asset allocation strategy

#MoneyPuzzle #InvestSmart #MutualFundsIndia #PersonalFinanceIndia #WealthBuilding

Why is Serving Tea a Measure of Marriageability?

Money & her: Talking about money is good for you

investment

Not equity returns, it’s asset ...

The pointlessness behind reckless trading ...

planning

Let’s settle this once and for all: rent versus buy

How to reach financial freedom

Why do we hate the ...

expert-byte

Quote of the Week

"Incentives are the silent architects of our financial destiny, shaping every choice we make with whispers of opportunity or consequence."