Summer break 2019 was not just about picture perfect landscapes and sing-a-longs, but more so about returning with two new learnings. Both in very different areas, but nonetheless as important.

Musings

The first one relates to this new, so-called, asset – crypto currency. There is little need to explain uncertainties around this asset. Crypto currency is an alternate form of payment or exchange for transactions and exists only in the virtual world. The supply and other features are distributed across a blockchain with people known as miners. Anyone can become a miner. Miners don’t necessarily know each other but are virtually connected through the crypto network. Any change can happen only when all agree. This decentralisation of supply is touted by some as the revolution in making to overthrow powerful control of a few on global money supply. At the same time many others are vary of this so-called asset given the obvious road blocks in accurately assigning value. How much is a bitcoin worth today? What are the fundamentals that will drive its price tomorrow? Its ability to become a peer to peer currency without the need for a singular authority approving its issuance is considered its biggest fundamental support.

Advancements have been quick.

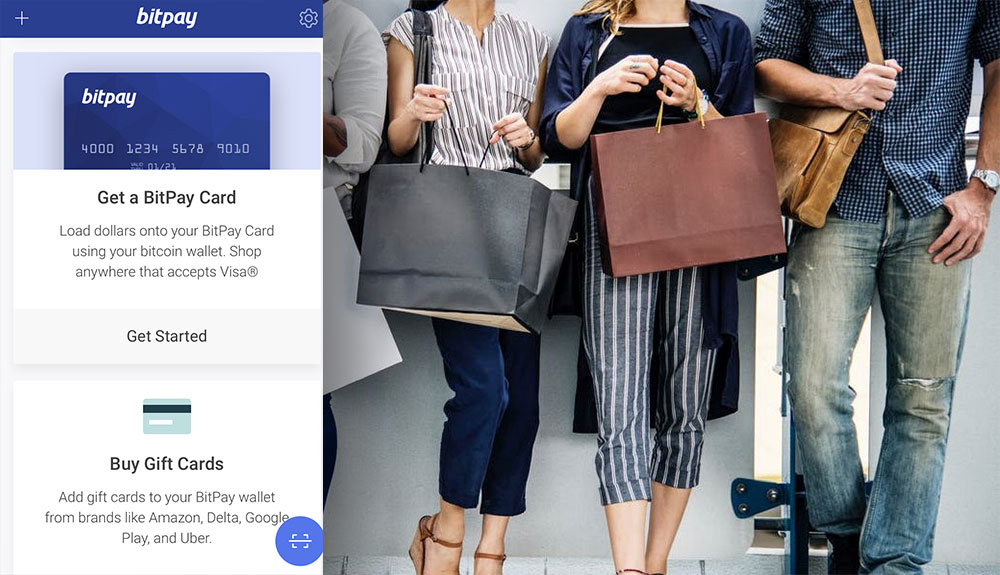

For those of you who are unaware, there exists something called bitpay. This is a VISA card, similar to other debit cards, which helps you pay in regular stores for regular stuff using your bitcoins.

During the summer break, a relative successfully transferred a few bitoins to me on an app. I can now sell them forward for the monetary currency I want.

It’s that easy now to convert virtual currency into actual stuff. Admittedly understanding the workings of crypto currency is complicated and not everyone is going to get it. Nevertheless, it’s elevation to utility is an important development. One which is now making me wonder if I may have been too quick to dismiss this as a fad simply because we have witnessed irreverent trading at the beginning of its journey.

My learning: don’t be hasty in writing off new asset classes. As technology takes over the world, we have to be more open minded about how it applies to traditional investments and their value.

I don’t understand crypto currency well enough as yet, but know that the rules of personal finance are really basic and, in many ways, remain static. Ultimately to achieve an outcome of wealth creation, similar principles of saving and investing are applicable to all. One of these is asset allocationAsset allocation is essentially an official term for what you intuitively know is a healthy investment practice. For starters most households are likely to own some property and gold. That is diversification in asset allocation. You allocate the money you... More. In my discussions around crypto currency I realised there is a bias to build a basket of investments around what we know best. Hopefully, the age-old learning of asset allocationAsset allocation is essentially an official term for what you intuitively know is a healthy investment practice. For starters most households are likely to own some property and gold. That is diversification in asset allocation. You allocate the money you... More was passed on to one such investor convinced that crypto currency is the only investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More required to secure his distant financial future.

Another rule. Given the factors involved, investing in currency is hardly recommended for the average individual looking for long term wealth creation. The same should apply to crypto currency as well. Which essentially means, keep your asset allocationAsset allocation is essentially an official term for what you intuitively know is a healthy investment practice. For starters most households are likely to own some property and gold. That is diversification in asset allocation. You allocate the money you... More simple. Growth assetsGrowth assets as against fixed return assets are those which grow your capital or principle investment. The most common forms of growth assets are equity stocks and property. Investing in equity stocks means you buy a portion of the underlying... More like equity or real estate (because many Indians claim to understand this asset class well) for long term wealth creation and accumulation. Fixed income assets like debt funds, deposits and bonds for your short erm parking of funds and regular income.

Restraint

The second learning is more about superfluous consumption rather than investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More advice. Before travelling overseas, there is usually a rough expense budget; multi-currency card(s) are then loaded with appropriate amounts (instead of wads of hard-to-carry-easily-stolen-cash). By the time we reach the airport to board the flight back home and start eyeing duty free, the cards are literally on their last dollar.

This year, a miracle happened; at the airport waiting for our return flight, there was still about 25% of the funds left over in the multi-currency cards. That has never happened before.

How did it happen this time? Over budgeting? Or maybe there is a certain saturation with mindless spending that’s slowly (real slow) but surely creeping in. When you see all the pointless widgets being sold and the bagsful of apparel across stores, at some point you are compelled to say no (to the next one). Utilising the budget to collect authentic souveneirs might be ok, but how many fridge magnets do you need? For now, I am rejoicing in finding that little bit of restraint. This self-discovery is worth pursuing and scratching beyond the surface.

My Learning: As consumers we have created a bottomless pit of ‘stuff’ in our cupboards and shelves. Reports on the suffering of other species and life forms thanks to our waste are becoming more frequent; we must reconsider our privilege as human beings. It is possible one small step at a time. As a first step spend less than you budget.

Who knows you may end up doing your future retired self a favour too.