Photo by rawpixel.com from Pexels

There is a lot being said about women and money. Admittedly, most of it comes in the month of March to celebrate international Women’s Day. But young men and women earning their way to a good life or managing household finances to maintain that good life – need to sit up and take note of financial awareness and action around it every day of the year and not just to honour one day in a year.

Isn’t investing the same for all? Then why is this commentary often tweaked explicitly for women, when we know that men will benefit equally to be financially aware? The answer lies in what we know intuitively and in what was confirmed in a recent survey on women and investing done by DSP Mutual Fund across slightly more than 4000 respondents from across the country.

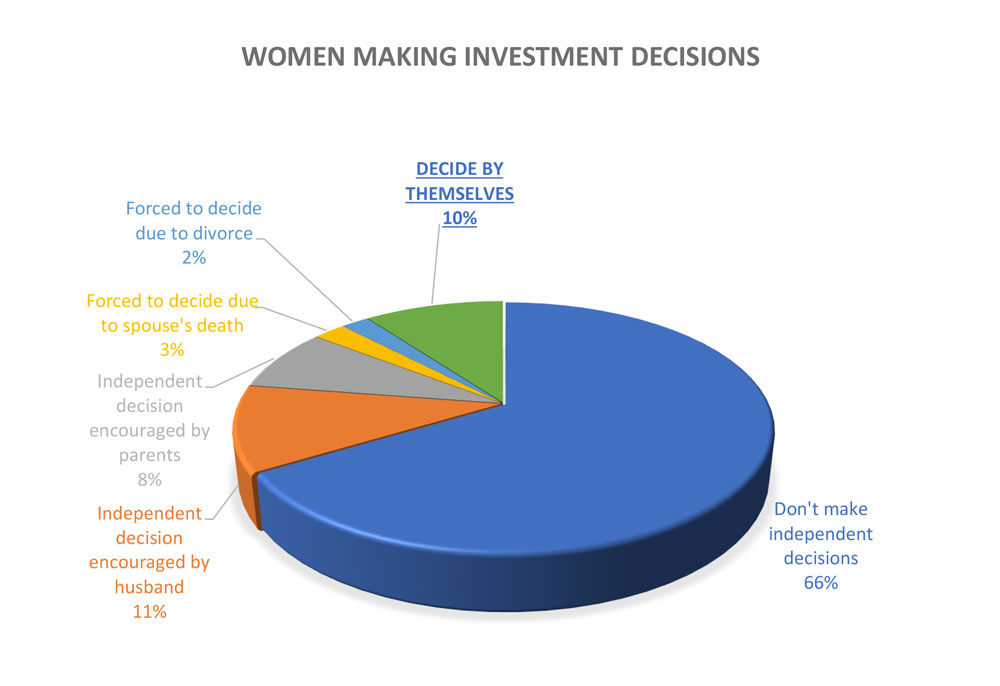

Unsurprisingly, the survey found that 33% women as opposed to 64% men make their own investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More decisions. Out of those 33% women, 57% are either encouraged by their husbands or their parents to do this. Hence, its not really that independent a decision.

The more worrying statistics is the 13% who are forced to do this because of circumstances like divorce and death of spouse. So, in other words women are either forced or encouraged when they make their ‘own’ investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More decision.

If I were to do a simple deduction, it shows that majority women are not inclined to making independent investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More decisions.

There are two whys here – why is it imperative that women learn to make independent investing decisions and secondly, why are they so hesitant to do that.

Why does it matter?

Firstly, it’s important for every one to be financial aware, to understand investing in order to create wealth and income for the future. Women are at least a 50% subset of this universe that includes everyone. One can’t shy away from money matters. In younger years, its more about spending, slowly the importance of saving creeps up and finally its wealth creation which one seeks as years of income generation come close to a peak. This applies to women as well – whether they are earning or not.

It is said that working women should be more in tune with their financial situation and hence, investments. At the outset – let me say that these definitions of working vs non-working women confound me. Usually, the so called non-working women are those who manage a home, children, elderly parents and its more about responsibilities towards the brood rather than an unwillingness or inability to go out and earn. Hence, they are not really non-working rather they are working but unpaid. I prefer to distinguish on the basis of office goers versus home makers.

For both, managing money and making investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More decisions is important. For single women without children or elders to support, making these decisions is about their own lifestyle. For those managing a family there is an added responsibility on investments for future expenses of others as well.

In the least, investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More decisions require to be a joint effort along with a spouse or parent whoever is otherwise making these investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More decisions.

Women at work routinely make decisions around the office about contracts or deals and at home about food and nutrition or children’s routine. Mostly, this is done with none others involved. Women have demonstrated confidence to participate in major decision making on most other fronts then why not on managing your money?

It matters because your future and the future of your dependents is tied into these decisions. It matters because inflationInflation is a common term thrown around in economics lessons and by politicians around election time. What it means in simple language is that prices of things you buy, stuff, keeps increasing every year. It happens because the economy in... More will eat away at your savings and allow you no luxury by the time income flow stops. It matters because being aware of your investments can make you financially independent which in turn brings a flurry of self-confidence, of better decision making and financial control on life’s outcomes.

Yes, this applies on men as much as on women, but the conversation for women matters more because we tend to give up on this subject of investments way too easily.

Why are women not involved?

In many cases, regardless of social status, its because men are perceived as being more powerful physically and more capable of decision making. I found this to be the case in many interactions with women, office goers and home makers, it didn’t matter whether the woman contributes monetarily to the household or not.

Office goers who added income to the household finances were satisfied in using it towards home expenses, indulging the children and some for say their elderly parents. Home makers are smarter sometimes in keeping aside funds for a rainy day, but that money is usually hidden away from the spouse and made redundant in its ability to create wealth because mostly it literally lies at the back of a cupboard or under the mattress.

For reasons which I am yet to comprehend, women in general, are simply not interested in making money decisions which don’t involve spending. It could be pure laziness, an ignorance of what financial stability can bring to lifestyle, to peace of mind or an innate adherence to societal norms of letting the man be in charge.

Whatever the excuse, its not good enough. Women are just as capable as men of making investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More decisions. Ideally, the only person they should be relying on is an advisor qualified to help make the right decision. Even the advisor will only help in guiding and educating, the decision should be yours.

Times are changing

Yes, but very slowly. Till yesterday gold was where most women ran to get financial stability.

As awareness grows, its clear that gold cannot help you create wealth for the future in the same manner as certain other financial and market linked investments can.

There are women advisors today and households where the lady of the house is responsible not just for the spends but also the investments. But they are few and far in between. The statistics on office going women has improved at a far greater pace than for women in charge of their financial future, ie investments. This needs to change for a better outcome not just for boosting self confidence of women but also for an improved state of family finances in an era of global uncertainty around employment and future earnings.

Be prepared – don’t aim to be part of the 65% who don’t make independent investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More decisions or the 19% waiting for encouragement or the 5% forced by extraneous circumstances – rather strive to join the 10% women who according to the DSP MF survey are already making independent investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More choices, giving them better control of theirs and their family’s future.