Photo by George Milton

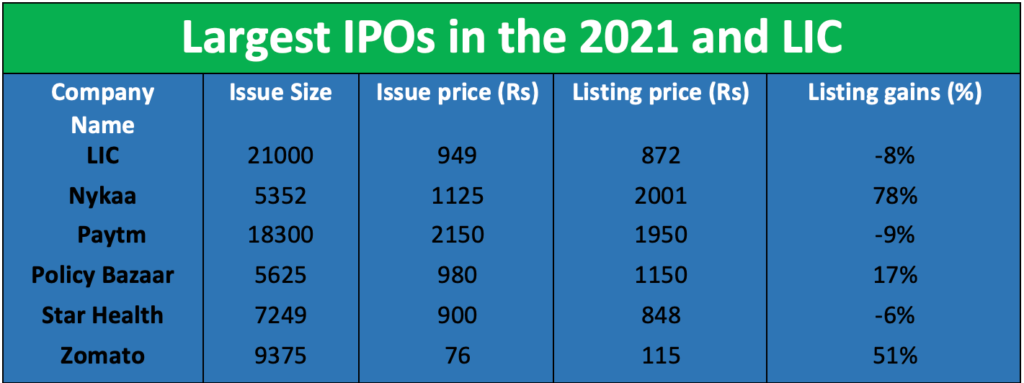

IPO was the buzzword for 2021, the year in which our domestic equity market saw 65 new listings in the broader market. The spotlight shone on the listing of popular fintech companies like Paytm, Nykaa, Zomato and PolicyBazaar. These four IPOs together collected around 39,000 crore and retail investors rushed in to get a piece of the pie.

In 2022 came the IPO behemoth, LIC launched its mega Rs 21,000 crore IPO, which is so far the largest for the Indian market and by the time it was closing, the issue was oversubscribed nearly 3 times. The portion reserved for policyholders was subscribed more than 6 times. Once again it’s the individual investor who showed the most faith in the prospects of this IPO. The assumption was that such an old and trusted Indian company has to do well.

However, for lakhs of individual investors, the IPO experience has since soured. LIC in particular disappointed in terms of gains right from the time it was listed. Do you really understand what you are buying when you invest in the initial public offer (IPO) of a hitherto private company? Is there merit in perhaps just ignoring IPOs and saving yourself the wallet burn?

What are IPOs?

IPOs or initial public offers are essentially the first time that a private limited company offers its shares to the public to invest in or to buy. Buying shares of a company makes you a shareholder with the right to receive a dividend paid out from profits and voting rights for corporate actions that require shareholder consent.

To ensure that there is a fair process when a private company first offers its shares to the public, the capital markets regulator, Securities and Exchange Board of India has prescribed an auditable process. As part of this process, you have to apply for shares in an IPO. IPOs of popular companies usually get over subscribed and allotment happens proportionately but in a lottery system. This means, there is a high chance that for an IPO which is high in demand you don’t get any shares allotted. Now there is a seven-day period from the time you subscribe to the listing date, the day on which the shares begin public trading on exchanges.

The assumption that many retail investors make is that an IPO will surely list with gains; empirically this is simply not a fact. Many IPOs list below their issue price, some make up the gap in the coming years and others don’t.

IPO investing is no different than buying any other stock, you must analyse the company and the price at which its shares are being offered for the IPO.

What can go wrong with over-enthusiastic IPO investing?

A popular private company doing robust business, one whose services even you use; it seems to be only growing in market share and is now offering its shares to the public, what can go wrong, it’s a must-have.

While it might seem that way. Almost everything that you want or assume will move in one direction can go wrong in an IPO.

Firstly, the IPO itself is just one way to invest or become a shareholder of a company you admire. It’s not the only way. Once the IPO is done and the shares list on stock exchanges, you can buy and sell them from the secondary market at any time. There is no restriction on how much you can buy or sell. Moreover, post-listing, the company mandatorily has to publish its quarterly financial reports and inform exchanges about any material corporate action. This means you have direct access to important information about the company after it has been listed.

Secondly, just like price is important while buying a house, gold, a car or even a kilogram of onions, price is important while buying into the IPO of a company. Unfortunately, it is also the most ignored factor. Here price does not mean the absolute number attached to the share, rather it means the value. In other words, we are looking at the price of the share relative to the earnings the company is capable of generating in the future. A suitable price is one that supports this earnings growth trajectory rather than inflating it.

Unless there is value, the price you pay for buying the share in the IPO is likely to be expensive and over the next few months after listing the share, you will see a decline in this value (price).

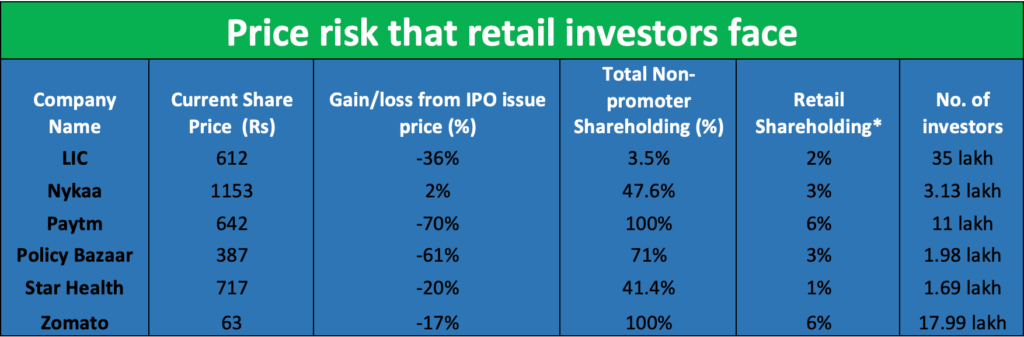

All the above IPOs were heralded by retail investors who jumped in, in lakhs. Today the shareholding pattern of LIC, for example, shows that retail investors have the largest piece of the pie other than the promoters. Unfortunately, the table also shows how returns have fallen since listing.

Hence, valuations can go terribly wrong in an IPO. This happens because the IPOs that have come to the market over the last decade or so are primarily companies where early private equity investors are looking for an exit. There was a time when IPO proceeds were used mainly to enhance the business growth of the company and in doing that as the business grew, so did the value for the IPO investors.

Understand that this early money for business growth now comes from private equity and venture investors. The price of the IPO is set such that they are the ones who benefit with a good valuation compared to what they paid to acquire the shares. These valuations are set with the help of investment bankers whose fees are linked to the amount of money raised. The higher that figure is, the higher their fees. Hence, for all stakeholders – the company, the early investors and the investment banker benefit from a highly valued IPO price.

The risk of this is borne by IPO investors. An IPO price which is too highly valued or expensive can correct substantially if earnings don’t match up to expectations and this is exactly how it has played out for the IPOs discussed above.

What’s the alternative?

If a company you admire is coming to the equity markets for the first time, be excited about this development, but better not to let your excitement convert into an investment. Give the company a year post listing to demonstrate favour built with earnings growth as per expected and a display of management’s capability in growing profits and market share. In the absence of this, it will be hard for the company to retain its value from the IPO price for a very long time.

Only once you have experienced the trend of profit growth for a year post-listing, should you consider investing in this stock. What is the hurry to invest in the IPO when you can get much better price discovery and access to information after the stock has been listed and has been trading on exchanges for a while?

Secondly, don’t let your stock selection be a slave to personal biases. You may like a company and even use its services widely, but that does not necessarily mean it’s a profitable company which can turn out profit growth each year to protect shareholder value. The more discounts you get on food delivery or on apparel purchases through an online app, the less money and profit margins they make. When this happens, shareholder value is lowered not enhanced. Now you may like the discounts on your purchases, but as a shareholder long-term discounting on products can cost you in share value.

There are several stocks which are already in the listed secondary market which you can buy and don’t need to wait for an IPO.

Investing in an IPO gives you no advantage over buying existing stocks. In fact recent experience on IPO pricing shows that buying IPOs is a costly affair and you end the paying the price of not being patient enough to wait for buying post listing and not being vigilant enough to judge the value over price of the stock.

Did this article help you understand IPO investing? Leave a comment

Also read:

Not equity returns, it’s asset allocation that matters most

The markets are correcting and that’s no news, but yes, we haven’t seen this sharp a downtrend is a while now.

The pointlessness behind reckless trading risks

Retail traders are rarely able to beat the market. This is what market regulator, SEBI’s study released in July 2024 showed; 7 out of 10 individual intraday traders in the equity have incurred losses in FY2022-23 as per the study.

Equity investing is more reliable than investing in real estate

In a growing economy like India, there are bound to be innumerable stories about how individuals have gained multiple times the value of their investment in real estate.

this literally opened my eyes, never this detailed things in an ipo and how to be away