Photo by julie aagaard from Pexels

Given the way equity, commodity and cryptocurrency markets have performed in the last 12-18 months, wealth creation and getting rich quick seems to be the primary objective of investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More action.

Investing, however, is not just about creating wealth, it is also about preserving wealth. This is where debt mutual funds or mutual fund schemes that invest in fixed income assets come into play. Wealth or capital preservation is underrated in today’s fast-paced and exciting world of risk assets like equities, commodities and even cryptocurrencies.

History has shown us time and again that crashes don’t come knocking. If you own quality assets, you can regain lost wealth over time. Unfortunately, when all kinds of asset prices are booming upwards, supported by lower and lower interest rates, it becomes too tempting to avoid those that are shooting up or to filter through a quality sieve.

What this means is that, more often than not, in a broad boom like situation, if you are not careful, it is relatively easy to pile on some poor-quality assets too. The best example in recent history is the boom-bust cycle in equity stocks at the turn of the century. This incredible rally just before its bust was led squarely by technology stocks that were quoting unrealistic valuations, but those prices were widely acceptable to investors at the time.

In the US several internet technologies stock-based funds were launched in the year 2000 and lost nearly all their value by 2002; these literally had to be shut down or merged. Investors were the only losers.

What do debt funds have to do with these kinds of sharp losses?

The point is that, when you chase only growth assetsGrowth assets as against fixed return assets are those which grow your capital or principle investment. The most common forms of growth assets are equity stocks and property. Investing in equity stocks means you buy a portion of the underlying... More in the hope for quick, high returns, chances are that some of those investments might go bust. Chances are that you may see a sharp downtrend in prices too, and if this happens at a time when you really were looking forward to using the gains from your investments, either for your business or for your children or for your retirement, you might find yourself stuck in a sharp correction.

This is where debt funds come in. These will help you keep your priority money in stable return options and they can help you cushion the fall in portfolio returns if there is a sharp crash. Thereby, giving you the benefit of a part of your portfolio delivering positive returns while the riskier part takes its time to recover.

Debt funds or fixed income funds are your safety cushion.

How does one pick a debt fund?

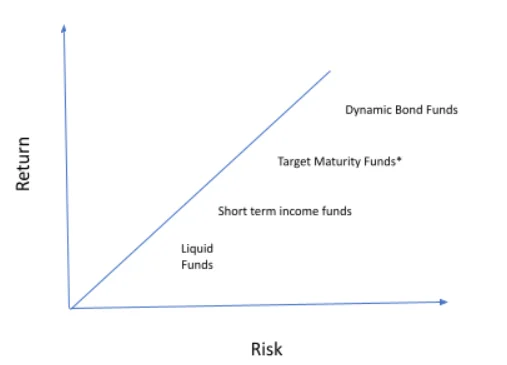

Debt funds come in many packages, to be precise there are 16 categories to choose from. Out of these are perhaps, four, which are relevant to individual investors looking to build a cushion for their investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More portfolio.

- Liquid funds

- Short term income funds

- Target maturity debt funds

- Dynamic bond fund

Let’s have a look at these one at a time.

1. Liquid Funds

Liquid funds are ideal for short term solutions. Let’s say you need money for a car down payment or school fees or home repair in 2-3 months or even 6 months, then liquid funds can be your go-to product. You can either leave your money in the bank account with easy access to spending it before you reach your goal or invest it in a liquid fund and withdraw when you need it (with a day’s notice). Currently, the annual returns on liquid funds are at a low 3.5%-4% given the low-interest rate situation in the economy, plus, the recent tendency to drive away from risk.

Given the return profile, you may prefer leaving the money in the bank, especially since any capital gains at withdrawal will be taxed. If you have good discipline over your spending habits, leaving it in the bank is fine, if not then better to incur some of those taxes rather than spending most of the money.

2. Short Term Income Funds

Short term income funds are good for putting aside some of that emergency fund money or money that you might need after say 2-3 years. Ideally, begin saving for your emergency fund through a liquid fund scheme and if you don’t end up using that money at the end of a year, shift it to a short-term income fund. These funds can also be used when shifting to stable return options 18-24 months closer to achieving your specific long-term goals. Investments for long term goals are best suited for risk assets like equities, however, the short-term volatility in such assets can impact the value of your fund at any time. Closer to achieving your goal, just shifting this money to a stable return fund like a short term income debt fund can help preserve capital and deliver returns.

At present these funds are delivering anywhere between 5.5%-6% annualized return. This is comparable with fixed deposit returns, but with much greater flexibility, ease of transaction and tax efficiency.

3. Target Maturity Debt Funds

Most target maturity debt funds come with portfolios that mature within a pre-determined period. The objective here is to invest in these schemes for a specified long-term period of say 3, 5 or 10 years. There is a small selection available from which you can choose. These fit in well when you want to balance your overall portfolio with no risk debt assets. They can also help in partial allocation for specific goals where the timeline is definite. These funds give you the benefit of visibility of approximate return in advance and also being able to match your investments with the maturity date. In open-ended target maturity schemes, you can enter and exit at any time, however, the return visibility is for a period matching the maturity of the portfolio and you will need to remain invested for that period in order to earn that return. Here the current returns can vary between 6%-7% annualized, depending on the time to maturity.

4. Dynamic Bond Funds

Dynamic bond funds are schemes where the fund manager has the discretion on portfolio duration and it’s most suited for a long-term allocation in your portfolio. Returns from this scheme can fluctuate in the short term and it’s only when you remain invested for over three years can you see accumulated returns becoming consistent, with the advantage of compoundingCompounding is the concept of earning return on both your principle investment and your profit. It is a way of calculating return that assumes you pull back your return till yesterday and remain invested so that any change in value... More. Here, the idea is complementing riskier growth assetsGrowth assets as against fixed return assets are those which grow your capital or principle investment. The most common forms of growth assets are equity stocks and property. Investing in equity stocks means you buy a portion of the underlying... More in a portfolio with a long-term debt strategy. Long term, 3-5 year returns for good quality funds in the category can be in the range of 8%-10% annualized return.

Risk-return graph for these different types of funds

How can you choose within a category?

There are some basic features you will have to keep in mind while choosing individual schemes from a category.

1. Duration or average maturity

This is perhaps the most important feature to check while choosing your scheme. It represents the interest rate risk in a scheme. In the case of debt funds, the higher the duration or average maturity, the higher is the risk. This risk we are talking about here is the risk of volatility in returns. One way to overcome this risk is by matching your time horizon for the investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More with the average maturity of the scheme and to remain invested throughout that period. For example, liquid funds have an average maturity of 60 days or less as compared to short term income funds which can have up to 2-3 years of average maturity. Hence, liquid funds are lower risk and are used for very short-term parking of money.

Within a category too, check the average maturity of individual schemes and then ensure it matches with your time horizon.

2. Portfolio quality

Whether it is stocks or bonds or equity funds or debt funds, quality has to be a priority. Poor quality investments can lead you down a rabbit hole and you may lose capital fast. Thankfully, in the case of debt funds quality can be judged easily because individual securities in portfolios are rated by credit rating agencies on their ability to repay investors. This rating is published alongside the securities in a portfolio which is published in the factsheet every month. A portfolio with the majority of the securities rated AAA by recognized credit rating agencies is considered as the highest quality. The highest quality may not mean the highest return, but remember you are not investing in debt portfolios for return, it is meant for cushioning and capital preservation. Hence, always aim for a majority AAA portfolio within any category that you are investing in.

3. Expense Ratio

This is a simple check, lower the better. The expense ratio represents the portion of the assets under the management of a scheme that is deducted for running expenses before calculating the daily price. Hence, a lower expense ratio will mean that the net return gets bumped up. Compare expense ratios of similar schemes before making a final choice. Where schemes are delivers low single-digit returns, a few basis points of expenses will make a difference to your net return.

4. Fund manager and scheme pedigree

Most debt funds are actively managed. The fund manager is crucial in deciding the portfolio quality, average maturity and management strategy. Hence, you need to prioritise who you select as a fund manager, their experience in the job, their time with the particular fund and their track record. It’s not just the fund manager’s track record, but also the scheme track record which matters. What you need to look for is not top-end returns, because returns are a function of risk and while choosing debt funds, we want to minimize risk. What you need to track is the consistency of performance in line with the portfolio quality. A portfolio that has 100% invested in AAA securities will rarely be the best performing portfolio in a category. However, such a portfolio can help you preserve capital very well. Hence, look for its historical return consistency over the long term, a consistent performance will mean that the fund has endured market cycles well enough.

It’s best to diversify your debt fund exposure across 2-3 schemes rather than putting everything into one.

Choosing the right debt fund is never an easy task. However, if you build a method into the madness and link your choices to the goals you have earmarked for that particular investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More, it will become logical and easier.

While choosing debt funds returns are the last priority. While this may seem counterintuitive, but if you keep reminding yourself of the reason you are investing in debt funds, this will become quite simple to understand.

Hope this helps you in making prudent choices in debt fund selection. For any queries and doubts, do leave a comment.

Alternatively, you can write to us at [email protected]

If you liked this article you might also like:

-

The calendar year has turned, don’t forget to mark the change in your portfolio too

It’s time to say Happy New Year – wishing you the best in 2026! Despite the celebration that invariably ensues – worldwide – to mark the change in the calendar year, a new calendar year, is actually a change that bears no practical significance for our lives.

-

Not equity returns, it’s asset allocation that matters most

The markets are correcting and that’s no news, but yes, we haven’t seen this sharp a downtrend is a while now.

-

The pointlessness behind reckless trading risks

Retail traders are rarely able to beat the market. This is what market regulator, SEBI’s study released in July 2024 showed; 7 out of 10 individual intraday traders in the equity have incurred losses in FY2022-23 as per the study.