One of the objectives behind writing ‘Money & her’ was to get conversations going. Conversations about personal money. Not in public but at least within your household where these conversations can literally change the trajectory of your future.

The average individual is averse to talking about money. Yet, money – how you earn, spend and invest it – impacts almost every aspect of your life. Not just that, money has the potential of impacting your mood and your emotions.

If you don’t like your job, but can’t quit because of the hefty home loan EMI you are paying, it is bound to cause you frustration leading to a whole lot of negative emotions. This will in turn impact your mood and your behaviour, the brunt of which is likely to be felt most by those closest to you and perhaps your subordinates at work. Eventually, work itself can suffer and the outcome of that can be a whole host of negatives.

Sure, I’m painting a grim picture. But the idea is not to demotivate you, rather it’s to show that even though money may not be the content of our daily actions, it is often the context we operate in.

Had there been an honest affordability conversation before taking on a large sized home loan, while being honest also about the fact that one’s job isn’t to their liking, the home buying decision could have been pushed a few years down the line. This helps with time to solidify savings and be in a place in life where a home loan repayment does not infringe on your freedom to make professional choices that suit you best. So you can look beyond the narrative that nudges you to take a home loan to save taxes while ignoring that there is a very real interest cost obligation, 70%-75% of which is front ended to the first 7-10 years of your loan repayment period.

Why don’t we talk about the absolute cost of a loan and focus only on the tax saving? This is a money conversation that very relevant.

Why don’t we talk about the rate of return from money being paid as premiumThis is the amount you pay for keeping an insurance policy active. Usually paid in a lump sum at the start of the policy term or annually through the term, it includes all the charges and levies by the insurance... More on an endowment or a money back life insurance policyAn insurance policy gives you the right to reimbursement or payment from an insurance company for losses agreed up on in a defined contract. A life insurance policy for example, needs the insurance company to evaluate a claim on the... More and why do we only talk about when the money will come back to us? This too is a very relevant money conversation.

Why don’t we discuss finances with our spouses in context to our life’s values and how we would like to evolve in life. This is a money conversation that is usually limited to buying a house, education and marrying off children. What about fuelling your identity in life, that requires money too and perhaps the most relevant for you. The home loan situation was just an example, but there are so many other situations which also need to be talked through.

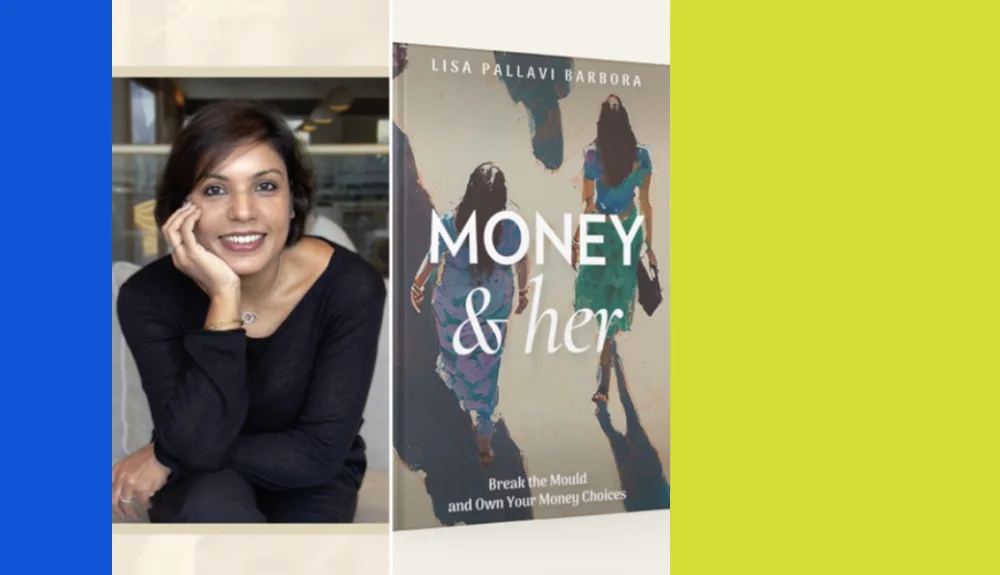

While ‘Money & her’ is a personal finance book about women and their relationship with money, money doesn’t really have a gender and we all – regardless of gender – must at least try to develop a positive relationship with money. Doing this opens up opportunities and helps you enhance the horizon of what you can truly achieve in life. The space you did not know existed, will become visible.

How does one get comfortable, talking about money?

There is a lot of judgement around personal money. If you are too rich, you are probably greedy. If you are too poor, you will be pitied. Are you a spend thrift, miser, gold digger, risk taker, money minded, upscale, downmarket and so on. Notice the negative connotation with the money adjectives?

No wonder discussing money is uncomfortable and has slowly but surely become a taboo in so many households. The cue comes from the patriarch of the house, whose money conversation is limited to how much unsolicited spending his wife does or the expensive dinner he treated his family to. The lady of the house affords much respect but not when it comes to money matters, “Ask your dad if we can afford that.”.

These are all subtle ways of sweeping a conversation under a rug. Its uncomfortable to bring up money when someone says ‘too much money corrupts’ or ‘money doesn’t grow on trees’.

You have to begin by changing the tone of a money conversation such that it sounds normal. Talking about money doesn’t mean you have to discuss the minutest detail of what happens in a month in your bank account. For any household or any earning individuals, three money topics are a must engage.

Firstly, talk about your savings. Are your monthly savings at least 20% of your monthly income. How are these savings getting invested, are you at least beating inflationInflation is a common term thrown around in economics lessons and by politicians around election time. What it means in simple language is that prices of things you buy, stuff, keeps increasing every year. It happens because the economy in... More? If this basic step is not happening, then you are not creating long term wealth with your savings.

Second thing to talk about is insurance. Is your family protected with a comprehensive health insuranceA comprehensive policy that covers for medical and surgical expenses that you incur. This includes hospitalisation expenses, pre hospitalisation expenses and other expenses incurred for all the illnesses covered in the policy. More plan and a term life insurance policyAn insurance policy gives you the right to reimbursement or payment from an insurance company for losses agreed up on in a defined contract. A life insurance policy for example, needs the insurance company to evaluate a claim on the... More. Both are crucial to ensuring that your savings can be put to their best use which is creating wealth while your family emergencies are protected with the right type of insurance.

Lastly, you need to have the net worth conversation. How much liability is there and when is it due? How much is invested across assets and what’s the risk of losing capital in each of these investments.

Begin here. It’s not good to generalise, but usually in a family, men will have this information and women won’t. But women live longer than men and need this information just as much as men do. There are thousands of crores lying unclaimed across bank accounts, fixed deposits, mutual funds and stocks, because this information is not shared within the family. It’s just lying with the banks and asset managers, of no use to anyone. So much wealth created, so much of one’s hard earned money, just idling away. Become money wise now and start an honest money conversation. It will help you in many more ways than one.

If you like what you have read – don’t forget to leave a comment and share your thoughts!

Also read:

-

Couples’ guide to money matters: Happy Valentines Month!

It’s the month of February, the month of love, red roses, grand gestures and unspoken desires. When love is in the air, no one really wants to talk money, even if they want to spend a lot of it. But here’s the truth. All your relationships, romantic or otherwise, rest subliminally on some financial foundation. …

-

The calendar year has turned, don’t forget to mark the change in your portfolio too

It’s time to say Happy New Year – wishing you the best in 2026! Despite the celebration that invariably ensues – worldwide – to mark the change in the calendar year, a new calendar year, is actually a change that bears no practical significance for our lives.

-

Why is Serving Tea a Measure of Marriageability?

It’s wedding season and dinner party conversations naturally veer in that direction; families meeting to find suitable matches for their sons and daughters, the modern bride progressively choosing lighter hues in make-up and in wedding attire, and of course the excitement of attending destination weddings which come with all the frills.