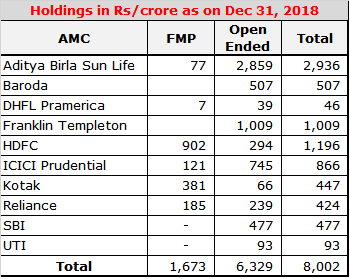

A lot has already been written about the recent deferred repayments in fixed maturity plans (FMPs) from Kotak Asset Management Company and also the rollover of another one by HDFC Asset Management Company. This is all happening thanks to these funds owning debt securities issued by Essel Group promoter companies which now have no liquidity to pay out their financial obligations to lenders. Other asset managers like Reliance AMC, Aditya Birla AMC etc (see table) seemingly are also wondering how to deal with FMPs holding this exposure which are due for maturity soon.

Unless you are an investor in these you may not realise what, the hue and cry is about. As it happens, a senior citizen, very well known to me had invested in the very FMP that has returned below par value to its investors. Is he perturbed, furious, not able to repay some instalment and so on? Not really. While one can argue that better judgement should have been used by whoever advised him to invest in this FMP in the first place (given the overallocation to Zee Group Promoter Companies and the fact that around 60% of the portfolio was invested in below AAA rated securities), fact is one thing that happened right for him is his diversified portfolio and this investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More itself is less than 5% of his portfolio.

Let’s try to make some sense out of it, a lot of the noise around this issue is too loud and largely incomprehensible. Firstly, don’t let this incident colour your relationship with other mutual fund schemes that you hold. Secondly, lets try to assign blame correctly and understand what risk means.

What is the issue?

Is it that a risk taken in a fund went towards the worst-case outcome rather than a full pay out as we have gotten used to? Or that asset managers by entering into an agreement with the promoter have colluded against the investor? Or that investors are largely clueless about this risk? Well, I would say, the issue is a little bit of all of the above.

The embedded risk came through

Mutual fund investments are subject to market risks. This is a standard, factual disclosure applicable to each and every type of scheme. It is not subjective or loosely applied anywhere. It means that all types of mutual funds carry some amount of market risk. In this light, let’s be clear that taking credit risk is not beyond the fund manager’s broad task.

However, what is pertinent in this case is the fact that many schemes have overallocated to the same borrower albeit under different companies. Now that is a risk which is hard for the investor to decipher, unless clearly stated upfront. This is the reason why disclosure standards should be questioned and counter questioned.

Advisors and fund managers often rightly advocate diversifying investments to ensure that risks are spread out. This ideally should happen in the fund portfolio too. Unfortunately, in a world where cash inflow is consistent and opportunities to deploy this money at any given time can be limited as the supply of debt securities is limited, diversification can become an idealistic goal rather than a sacrosanct rule.

Was the lending structure to blame?

Is lending to promoter companies with no clear cashflows warranted in products which are meant to be more for stable returns? Asset managers argue that as long as the lending is secured, they are comfortable with the exposure. However, it is not as simple.

Firstly, the security is meaningless if you can’t enforce it. Which is what has transpired. For the asset managers its really a catch 22 situation. Exercising the security and selling shares would have meant realising sub optimal returns for the investor. Holding back till the promoter realises a sufficient cashflow for a better return, has meant being subject to allegations of collusion with the promoter. The decision to hold was taken because the two underlying shares which have been pledged as collateral fell close to 30% each on a single day on a low volume trading scared the lenders.

Did their action to not exercise the collateral don them with a lender cape rather than that of an asset manager? Perhaps yes. As asset managers they should have recovered what they could and written off the rest. That would have been the best-case scenario for the worst-case risk. Technically, however, they were not out of line to hold back redemption as per the scheme information document. But it’s a grey area at best; when you read the corresponding detail in the scheme additional information document, it clearly says that restriction on redemptions owing to liquidity issues are relevant when almost all securities are affected rather than specific securities.

The other thing that confuses me is this. The total outstanding loans for the promoter group companies is said to be around Rs 13500 crore (as stated by Kotak AMC MD on a media platform) across several lenders. Now the collateral against this amount could be Dish TV or Zee Entertainment shares. Some lenders may have secured it at 1.5 times and others at 2 times. The free float market capitalisation of Zee Entertainment is around Rs 23,000 crore and Dish TV is around Rs 2600 crore. Do the math, in the event of a credit issue like now, the pressure on the stock price was bound to build up given the kind of collateral value outstanding. Even if we assume 1.5 times, we are looking at a stress on roughly 80% of the market cap coming up over a period of few months. The credit event happens once and affects all at the same time. Sure, not everyone will want to sell at the same time, but its clear that when the risk is known it doesn’t matter that maturities differ. How would the stock have absorbed this kind of selling anyway?

This was clearly a case of over leveraging by the borrower. Could the lenders have checked this? How many shares are pledged as collateral and how many times their value? The quality of risk practices within an AMC lie in these details. One can argue that this is all in hindsight, that 3 years ago this was not foreseeable. Hence, the need for risk practices like exposure limits, double check on collateral and so on.

Are allegations of siding with the promoter justified?

It can appear that asset managers have decided to give the promoter another chance in a bid to save their skin. While I agree that selling the shares and realising whatever value would still be a better fiduciary disposition rather than relying on the word of the promoter. At the end of the day, if after six months, the promoter is unable to build up cash flow then we are back to square one, no better off. That is a risk very much on the table and now an unknown. To my mind, it is better to deal with what was known, take a hit if it was required rather than go down another unknown path. However, as a fund manager confided, if collateral had been sold at a low price and later the stock price recovers, investors would be furious with the low value realised for them. Like I said a catch 22 situation.

Whatever decision is made whether to defer a part of the payment or roll over, along with looking out for the investor pay out, the AMC is also trying to do what’s best for their long-term track record. If things work out, in the long run the final performance or pay out is what will be remembered, not the turmoil in between.

What can investors do?

Like the gentleman I know who hasn’t received the amount he expected from his FMP redemption, if you already own these FMPs there is nothing much you can do.

If you are a mutual fund investor, understand that there is no real advantage in being in closed end products whether equity or debt. Distributors make higher commissions, but you are always better off in products where money is accessible at all times. Fund managers too have more flexibility to make up return short falls in open ended schemes rather than closed end schemes. So, stick to that.

If you haven’t yet started with mutual funds, don’t let this incident deter you from investing and there is no reason why you shouldn’t pick funds from the asset managers involved in this mess. There is a definite long-term track record, which one incident should not erase. Asset managers make mistakes in picking securities. In this instance the reaction is questionable, but it is not entirely against their fiduciary responsibility. Ultimately, if the money is paid by the end of September or if the asset manager has to sell the shares, all proceeds will be given to investors. Could they have done better by the investor. Yes, I think so. Better advance communication, better decision making, better due diligence and better instincts. But this failure does not take away from successes that have happened and returns that have routinely been delivered.

The credit cycle gone bad has definitely brought asset managers up on the credit risk learning curve.

Plus, you have to diversify, even if your fund manager doesn’t. Diversify across assets, across asset managers and across product sub types. A balanced asset allocationAsset allocation is essentially an official term for what you intuitively know is a healthy investment practice. For starters most households are likely to own some property and gold. That is diversification in asset allocation. You allocate the money you... More is the simplest way for you to minimise risk while maximising return.

Assigning blame

What about the credit rating agency? Well, the less said the better. How the rating of these securities is still retained is baffling to me. It seems that in certain cases, their job is restricted to printing a rating against the fee they receive. A hard look needs to be taken by the regulator at the lapses here.

Lastly, what more should the regulator do? SEBI came up with a risk o meter for investors to judge the risk level of funds according to that, the FMP which didn’t return capital has moderate risk marking on this risk o meter. Should it have indicated high risk, given the portfolio quality? I am not sure as I don’t know the process behind this risk o meter, but surely, we can see it did not say low risk.

I have stated this before; SEBI has to consider that its not just credit opportunities funds which will take credit risk and accordingly the band or the range for credit risk in duration funds or in such closed end funds needs to be defined in some form.

The MF industry does a lot of communication on returns and simply not enough on risk. This must change. The disclaimer on market linking is not enough. There is no explanation anywhere that risk means loss of capital, actual loss of your original investmentAn investment is made to give you a return. You make an investment if you use your money to buy either physical assets like property or financial assets like bonds and equity with an aim to receive income or gains... More. Especially in case of debt funds, this has to be better explained and communicated. Even though the probability of the risk playing out is low, it is not nil.

Let’s not shy away from this conversation anymore and that responsibility is foremost on advisors, on the regulator then on asset managers and AMFI too has to increase its volume in difficult times.