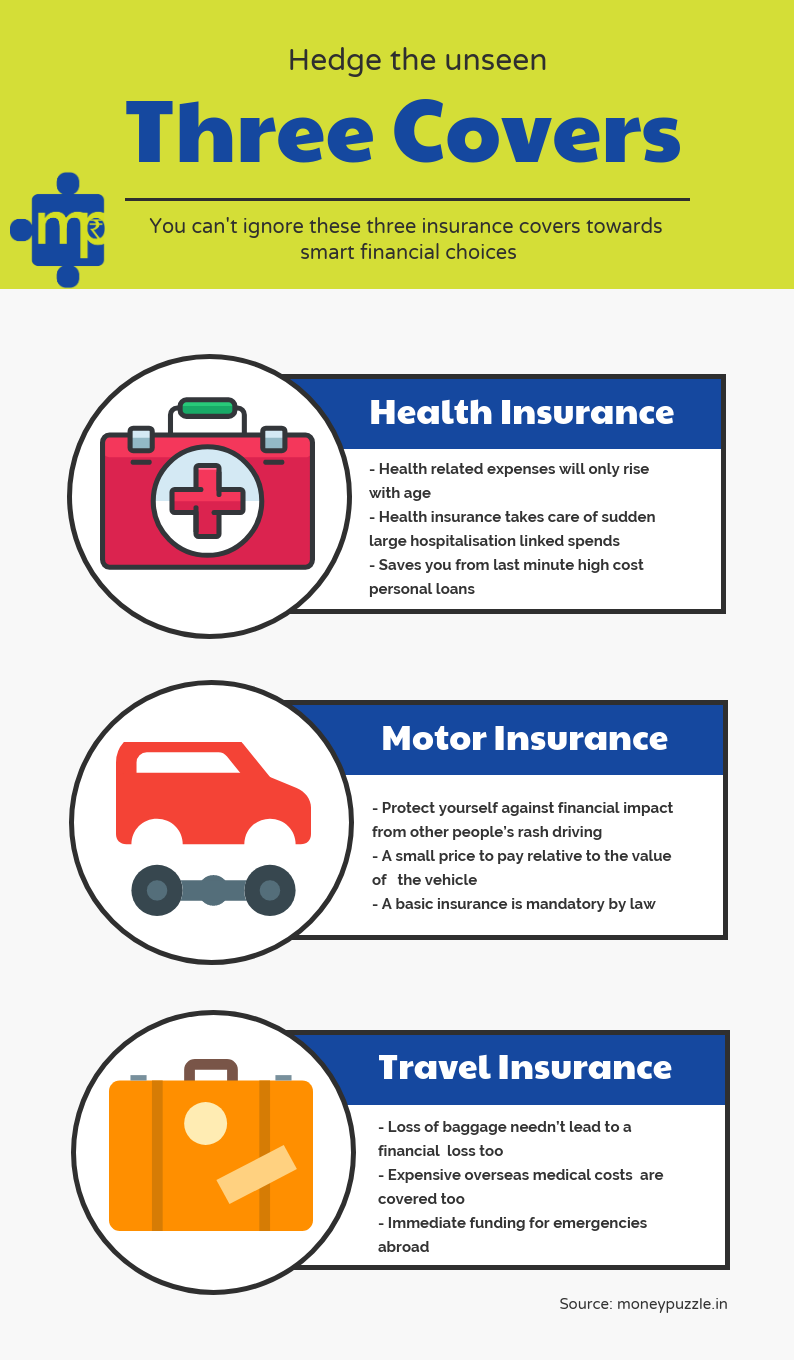

Insurance covers work like a hedge; protecting you against the unforeseen financial consequences of sudden accidents in life.

The largest sudden cost you could face is medical expenses. Not only would you have consultation fees but medical expenses have increased substantially over the years. And god forbid if you have to get hospitalised then the expenses would really shoot through the roof! One way to protect your savings in case of medical emergencies for your dependents or yourself is to have adequate health insuranceA comprehensive policy that covers for medical and surgical expenses that you incur. This includes hospitalisation expenses, pre hospitalisation expenses and other expenses incurred for all the illnesses covered in the policy. More cover.

Then there is the matter of road accidents. Even if you get away unscathed, your vehicle may require repairs that can set you back a whole month’s savings. To avoid this hammer on your wallet, always have your vehicle insured for third party faults.

Lastly, get yourself covered while travelling, especially if it is overseas travel. Travel insurance can save you needless over budget spending in case you lose your bags or if you have some medical emergency while on holiday or if you lose essential documents or miss a flight.

These three insurance covers come at a very low price per year and keep your savings protected from sudden large grabs if any of the above unexpectedly transpire between your best-laid plans!